he financial world is on edge today — September 17, 2025 — as the Federal Open Market Committee (FOMC) convenes to decide on American interest rates. After months of speculation, there is near consensus among markets, economists, and political observers: a rate cut is almost certain. But what sort? When? And how big will the cut be? Let’s dig into the latest.

📅 What’s the Meeting About & When

- The current, scheduled FOMC meeting is happening September 16–17, 2025, as part of the regular calendar.

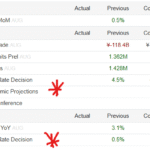

- Policymakers will release updated economic projections along with their decision, covering inflation, unemployment, growth, and their future interest rate path.

- The policy statement is expected around 2 p.m. ET, followed by Fed Chair Jerome Powell’s press conference.

🔍 What Markets & Economists Expect

- A rate cut of 25 basis points is widely expected. Most sources and Fed‐watch tools place the probability of that around 95-96%.

- The current benchmark rate is in the 4.25%–4.50% range and has been held steady since December 2024.

- There are also expectations of further cuts later this year — possibly in October and December — depending on how inflation, jobs, and other economic indicators evolve.

🤝 Trump’s Role & Political Pressure

- Donald Trump has been vocal in demanding larger and faster rate cuts, criticizing the Fed’s policies for being too slow and maintaining rates “too high.”

- A new Fed Governor, Stephen Miran, a Trump aide, has just been sworn in, which may shift dynamics. Meanwhile, Trump’s administration is pursuing removal of Governor Lisa Cook, a process currently tied up in court.

- These political pressures raise concerns about the Fed’s independence — can rate decisions remain purely data-driven, or will politics force deeper cuts than what economic data supports? Observers are closely watching any dissents in today’s meeting.

⚠️ Why It’s a Delicate Balance

The Fed has a “dual mandate”: to maintain price stability (keep inflation low) and promote maximum sustainable employment. Right now, both goals are under pressure:

- Weakening labor market signals — job growth has slowed, and hiring is less robust. This creates pressure to ease rates to support employment.

- Inflation remains elevated — while it has cooled from its peak, it is still above the Fed’s long-term target (around 2%). Tariffs and supply chain issues are also pushing prices in some sectors.

- Cutting too much too fast could risk inflation coming back and hurting credibility. Too little and the economy might slow into a recession.

📈 Likely Outcomes & What to Watch

Here are some of the possible outcomes and what to look for:

| Scenario | What Might Happen |

|---|---|

| A 25 bps cut | This is the baseline expectation. Stabilizes borrowing costs slightly, gives consumers and businesses a bit of relief. |

| Larger cut (50 bps) | Less likely — would require very weak data or strong political pressure. Could trigger fears of inflation resurgence. |

| No cut | Surprise, but possible if inflation data or other economic indicators turn out worse than expected. That would likely cause market sell-off. |

| Fed projections & dot plot | Key stuff: Fed’s updated projections will show how many rate cuts are expected in the future, how they view growth/unemployment. |

| Dissent in vote | Some Fed governors (especially those recently appointed or close to Trump) may push for deeper cuts — could signal internal splits. |

🌎 Global & Market Impacts

- U.S. Stock Markets: A cut may give a boost to growth-sensitive sectors: banks, housing, consumer discretionary. But markets dislike uncertainty, so clarity in Powell’s tone will matter.

- Bond Yields & Dollar: Expect yields to drop slightly; the dollar could weaken, benefiting emerging markets and exports. However, if Fed signals inflation risk persists, yields may stay high.

- Consumers & Borrowers: Mortgage rates, car loans, credit cards may get a tiny bit cheaper. But real relief depends on how much passes through from Fed rate to actual lending rates.

✅ Final Thoughts & What’s Next

Today’s Fed meeting is not just about whether rates will be cut — it’s about how the U.S. navigates a crossroads of economic risk. With labor market softness, inflation above target, and political winds blowing, the Fed’s decision and statements will be scrutinized like never before.

- Most likely outcome: 25 basis point cut.

- But keep an eye on the projections, the dot plot, and any dissenting opinions — they’ll tell you where we’re headed.

- Also, watch for how Trump reacts: Will he push for bigger cuts or criticize the Fed no matter what it does?

📰 Key Latest News Snippets

- Markets are mixed ahead of decision — some optimism but also caution about inflation.

- Analysts expect broad gains in U.S. stocks if the cut happens as priced in.

- Trump has sworn in Stephen Miran, putting his influence more directly inside Fed policy-making.

- Many expect 3 cuts this year — one today, then in October, probably December.

“Mohun Bagan कलेजे का मुकाबला: Ahal FK से ACL2 में बढ़िया शुरुआत की तैयारी!”

MSME पर BIS के Quality Control Orders का आक्रमण: पूरी कहानी

“ PAK vs UAE Drama: रिफरी विवाद के बीच मैच हुआ पूरा Reschedule — PCB ने धमकी पर दिया ये निर्णय!”

Follow us :- https://www.facebook.com/NewsF0xy/