Stock Market Key Headlines

- Sensex climbed ~314 points to settle at 81,101, while Nifty 50 closed around 24,868—a gain of approximately 0.39%.

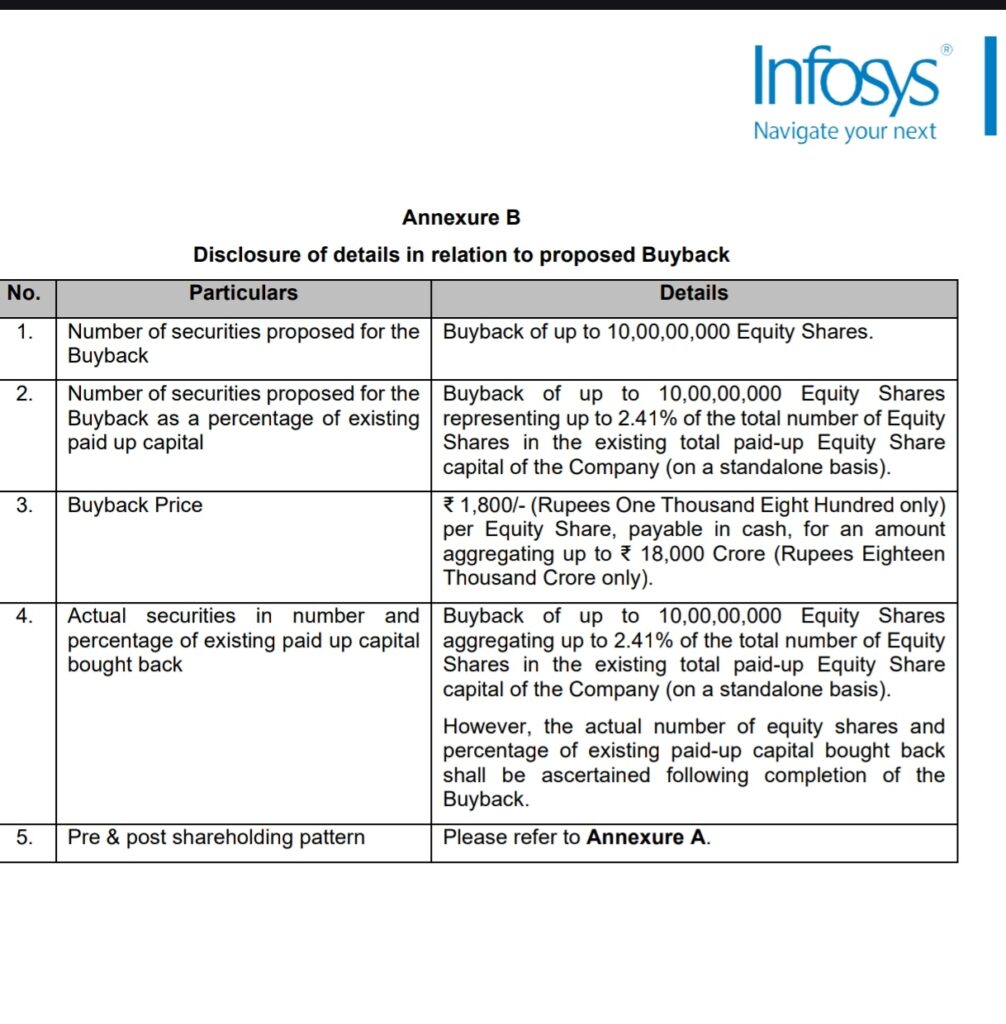

- IT sector led the rally, driven by Infosys announcing a share buyback proposal. Infosys surged over 4%, lifting the entire IT index by ~2.7%.

- Rupee briefly strengthened past the 88/USD level, reaching 87.95 before easing back to around 88.12.

- SEBI is fast-tracking IPO approvals—cutting timelines from 6 to 3 months—with hopes of record fundraising this year.

- Nifty remains anchored at 24,800, showing cautious stability. Analysts are eyeing breakout signals with Aditya Birla Capital and Adani Ports as top picks.

Stock Market Snapshot Table

| Metric | Detail |

|---|---|

| Sensex | Up ~314 pts to 81,101 (+0.39%) |

| Nifty 50 | Rose ~95 pts to 24,868 (+0.39%) |

| Major Sector Driver | IT sector led by Infosys buyback buzz |

| Forex Movement | Rupee 87.95–88 vs USD |

| Market Sentiment | Awaiting breakout near key support levels |

| IPO Pipeline | Accelerated approvals, strong upcoming activity |

What’s Fueling Today’s Stock Market Rally?

- Infosys Buyback Boosts Confidence

The buyback proposal has injected positivity across the IT sector, with major peers like TCS, Tech Mahindra, and HCL also higher. - US Rate Cut Hopes Elevate Sentiment

Softer US job data has heightened expectations of a Fed rate cut, swinging investor appetite back to risk assets like Indian equities. - SEBI Accelerates IPO Timeline

With the regulator aiming for 3-month IPO approvals, high-profile offerings—LG Electronics India, Physics Wallah, WeWork India—are coming soon. - Rupee Volatility Flags Cautious Trade

Despite momentarily testing deeper levels, the rupee failed to hold gains under persistent dollar demand pressures. - Watchful Mood Around 24,800 Support

With markets waiting for clear triggers, attention is sharply focused on sectors and breakout thresholds.

Broader Themes at Play Stock Market

- GST Reform Optimism: Expectations for sweeping GST updates continue to buoy sectors like automobiles and consumer goods.

- Global Macros: Russia’s OPEC supply tweaks and US Fed signals lend supportive global context to market momentum.

- Valuation Watch: Even with gains, most rallys remain measured—not overheated—displaying mature sentiment.

Final Take

The Indian stock market demonstrated resilient strength on September 9, propelled primarily by a spirited IT rally and Infosys’s noteworthy buyback move. Supporting macro cues—U.S. rate cut signals and domestic fiscal optimism—combined with eased IPO norms suggest further positive momentum ahead.

That said, both investors and watchers remain vigilant around the 24,800 Nifty level, pondering whether the market continues its upward trajectory or pulls back amid cautious sentiment.

Breaking Crypto Update – September 9, 2025: Market Rallies, Meme Coins Roar

“Linea Token Debuts on September 10: The New Layer-2 Revolution Arrives”

🚨 ब्रिक्स शिखर सम्मेलन में भारत का बड़ा संदेश 🚨

Follow us :- https://www.facebook.com/NewsF0xy/