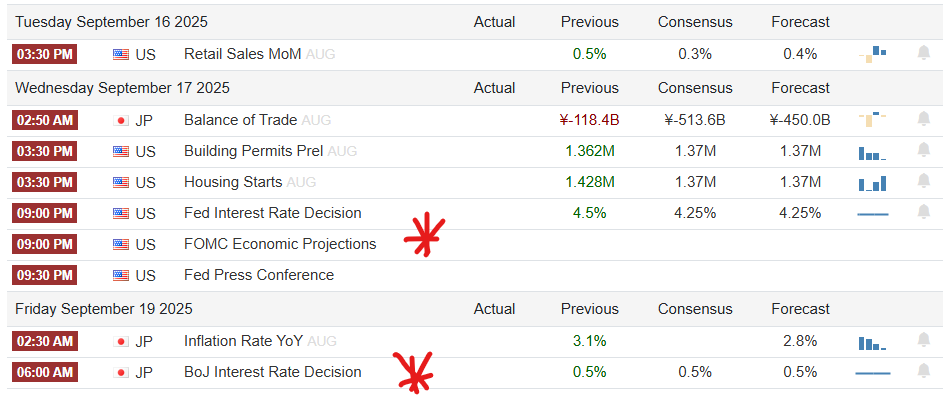

Financial markets across the globe are holding their breath as the Federal Open Market Committee (FOMC) gears up to announce its next decision on the Federal Reserve interest rate tomorrow. Investors, traders, and policymakers alike are bracing for impact because this meeting could set the tone for the global economy for months to come.

The keywords on everyone’s lips are #FOMC and #FedRate — but another name that keeps popping up in conversations is none other than Donald Trump. The former U.S. President has been unusually vocal in criticizing the Fed’s policies, and his shadow looms large over the narrative.

📌 Why This FOMC Meeting Matters So Much

The Fed’s decisions are never minor events, but this one feels particularly decisive. Inflation in the U.S. has cooled down from its multi-decade highs but still hovers above the Fed’s comfort zone. On the other hand, economic growth is showing signs of slowing, and unemployment is creeping up.

- If the Fed cuts rates: It would signal concern about slowing growth and could boost stock markets in the short term.

- If the Fed holds rates steady: It means policymakers are still focused on inflation, even if growth takes a backseat.

- If the Fed raises rates (unlikely): It would shock the markets and trigger massive volatility.

Either way, tomorrow’s FOMC rate decision will ripple across equity markets, bond yields, commodity prices, and even cryptocurrencies.

📌 Trump’s Voice in the Fed Debate

Donald Trump has always had a tense relationship with the Federal Reserve. During his presidency, he repeatedly pressured Fed Chair Jerome Powell to slash rates faster, often taking to Twitter to call out the Fed for being “too slow” or “clueless.”

Now, with Trump making a political comeback bid, he has once again waded into the debate, accusing the Fed of being “politically motivated” and not acting in the best interests of American workers.

In a recent statement, Trump said:

👉 “The Fed should focus on growth and jobs, not on pleasing Wall Street elites. If I were in charge, rates would already be lower, and America would be booming again.”

While Powell has maintained that the Fed is an independent institution, Trump’s commentary adds political drama to what is otherwise a technical economic decision.

📌 Market Reactions Ahead of the Announcement

As of today, Wall Street remains cautious.

- The Dow Jones and S&P 500 have been trading in narrow ranges, reflecting uncertainty.

- Treasury yields have moved slightly lower, suggesting some traders are betting on a rate cut.

- Gold and Bitcoin have both inched upward, classic safe-haven plays when volatility is expected.

Analysts believe tomorrow’s FOMC announcement could lead to a 1,000-point swing in the Dow, depending on the tone Powell strikes in his press conference.

📌 Global Impact of the Fed Rate

The Fed’s decision is not just about America. When the U.S. sneezes, the world catches a cold.

- Emerging markets like India and Brazil watch the Fed closely, because a higher U.S. rate usually triggers capital outflows.

- The dollar index has been firm, but a rate cut tomorrow could weaken the greenback and support global currencies.

- Oil prices may also react sharply, as cheaper borrowing costs often mean stronger demand outlook.

In short, tomorrow’s FOMC announcement will decide the direction of money flow worldwide.

📌 What Analysts Are Saying

Top economists are divided:

- Some argue the Fed must cut rates now to prevent a deeper slowdown.

- Others say cutting too early could reignite inflation, undoing the progress of the past year.

- A minority even think the Fed will hold rates steady until after the U.S. elections to avoid political controversies — though Powell has dismissed this notion.

The only certainty? Tomorrow will be a market-moving day.

📌 The Trump Factor Moving Forward

Trump’s return to the political stage means the Fed’s independence could face new tests. If the Fed decides not to cut rates, Trump will likely slam Powell and accuse the institution of slowing down the economy. If the Fed cuts rates, Trump will claim credit, saying his “pressure worked.”

Either way, Trump’s commentary ensures that tomorrow’s #FOMC decision won’t just be about numbers and charts — it will also be about politics, personalities, and the future of America’s economic direction.

✅ Conclusion

The countdown has begun. Tomorrow, the FOMC will decide whether to cut, hold, or surprise the world with a different move. Markets are jittery, analysts are divided, and politicians are circling like hawks.

One thing is clear: The decision on the Fed Rate will shape not only Wall Street’s immediate moves but also the global economic outlook for the rest of 2025. With Donald Trump already turning it into a political battlefield, the stakes have never been higher.

👉 Buckle up. Tomorrow’s FOMC meeting could be the financial story of the year.

BIG BREAKING: जय शाह ने PCB की मांग ठुकराई – क्या पाकिस्तान एशिया कप से बाहर होगा?

“Hera Pheri 3 विवाद खत्म — Paresh Rawal ने Priyadarshan से बोले ‘ग़ाव भर गया है’”

NSE Pre-Open आज: Nifty-50 आसमान की ओर या निकट समर्थन की परीक्षा?”

“Elon’s Billion-Dollar Bet: What Tesla Share Price on Sept 15, 2025 Means for Investors”

Follow us :- https://www.facebook.com/NewsF0xy/